Some have spoken out to say that DAO’s are going to be where NFT’s are now. And if you’re a little bit like me that FOMO immediately starts to take over and obviously makes you want to invest all your assets in the next big DAO.

But wait, calm your nerves and let’s first dive deeper into what a decentralized autonomous organization is. Together with a few examples of current DAO’s we’re going to figure out what the impact of DAO’s can be during the next years and onwards.

What is a Decentralized Autonomous Organization (DAO)?

The term DAO is creating a lot of buzz among investors lately. I know what you’re thinking, you only just got your head around NFTs now you have another acronym to battle with. Or maybe you’re already on your way to investing in this new craze fuelled by a potent mix of optimism and FOMO?

Not so fast.

It’s important to know that DAO is an umbrella term that contains a vast number of different groups and possible businesses. But, what exactly is a DAO and is the hype justified?

In this article, we’ll look at the history of the DAO, how it’s being used today, and what the future may hold. We’ll find out if the DAO is just a fad or if it’s something that will change the way we live, work and invest in the future.

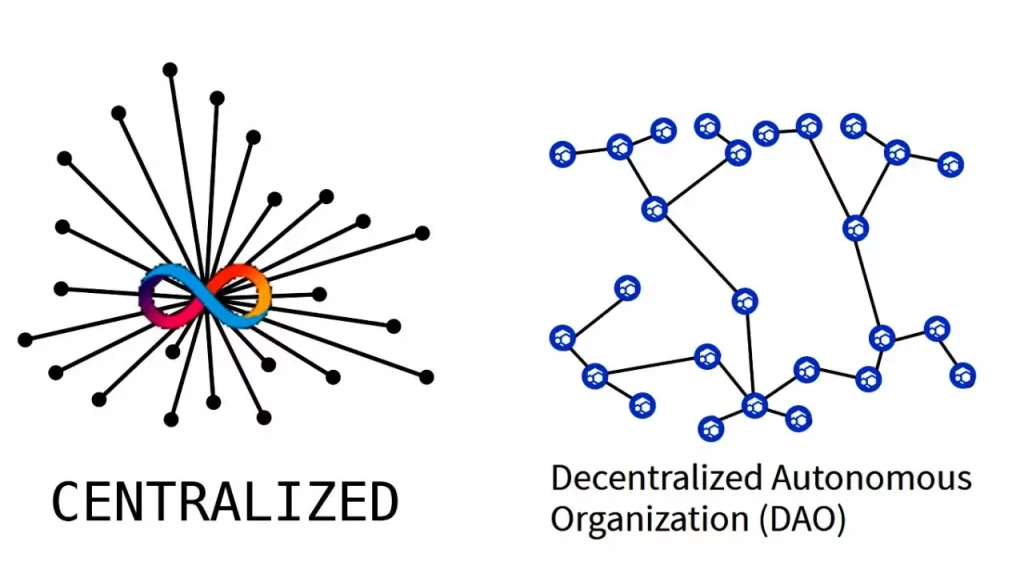

Decentralized – Dispersion of functions and powers

Autonomous – Self-governing

Organization – A functional structure

Part of the appeal of cryptocurrencies is the fact that they’re decentralized. This means that they aren’t under the complete control of an individual institution like a bank or a government. Instead, they’re distributed among multiple computers, networks, and nodes. This decentralization allows cryptocurrencies levels of security usually unavailable to fiat currencies.

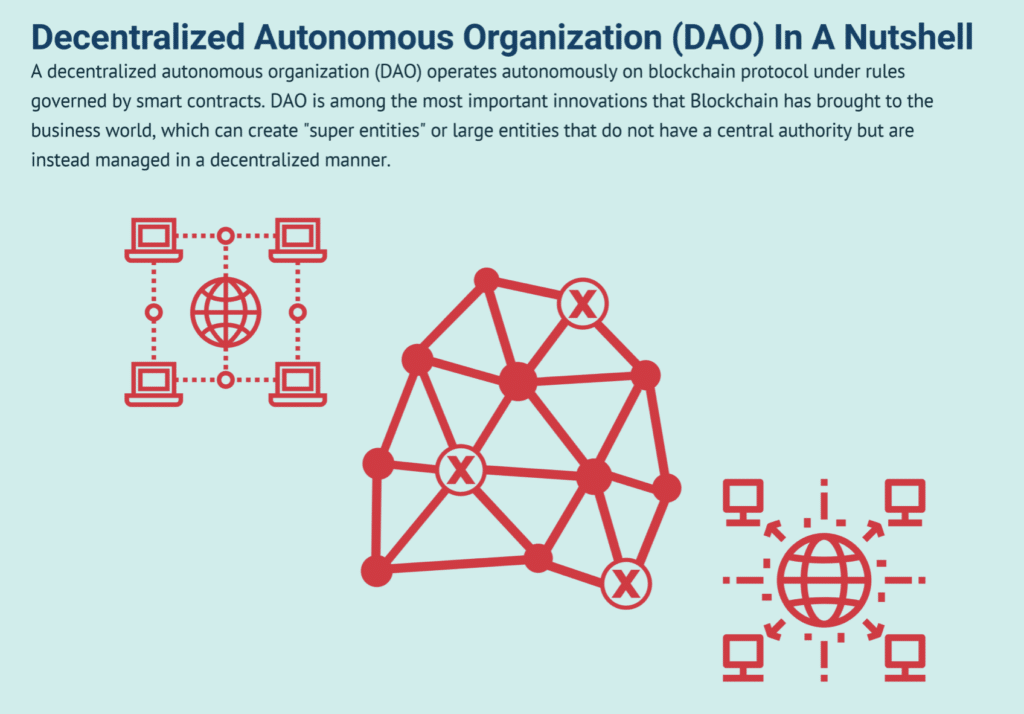

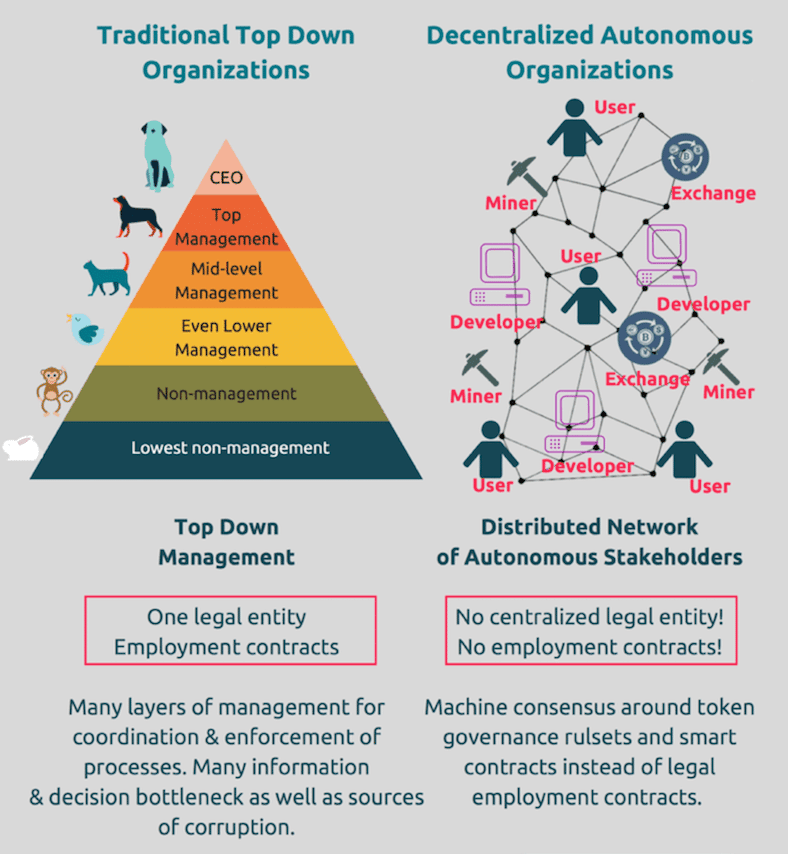

A decentralized autonomous organization (DAO) consists of software operating on a blockchain that encodes its rules and financial transactions on a blockchain. This is in stark contrast to traditional organizations controlled by boards, committees, and executives.

So, instead of being controlled by a single entity, DAOs are governed by a set of rules written in code shared among multiple computers (and people) via shared software.

Some examples of DAOs you might already be familiar with include the cryptocurrency DASH, Augur, Steem, Uniswap, The DAO, PleasrDAO, and ConstitutionDAO (more on those later!)

A Brief History of a DAO

In short, the short history of a Decentralized Autonomous Organization;

The DAO

The first DAO (fittingly named The DAO) was created by developers to automate decisions and make cryptocurrency transactions easier. It was built on the Ethereum blockchain as a smart contract.

The aim was to remove human error and corruption by transferring the decision-making power to an automated system and a crowdsourced process, essentially operating as a venture capital fund in the crypto space. This meant that investors could send money anonymously from anywhere with an internet connection.

The platform would also allow people to pitch their ideas to the community giving them an opportunity to receive funding from the DAO. In exchange, the DAO would issue tokens that gave investors input into current or future projects with rewards and other incentives up for grabs should those projects prove profitable.

The DAO was officially launched in April 2016 with the help of a crowd sale of tokens that amassed over $150 million in funds (at that point, the most successful crowdfund ever). During this initial creation period, anyone with Ethereum could send coins to a wallet address in exchange for DAO tokens.

The DAO gets hacked

In June 2016 The DAO was attacked by a hacker who found a flaw in the coding. They managed to drain 3.6 million ETH ($70 million at the time) from the fund in the first few hours. The bug didn’t come from Ethereum itself but from a single application that was built on the platform. Luckily the funds were subject to a 28-day holding period, which lead to the investors being refunded.

The DAOs code had several flaws, one of which was a recursive call exploit which happened to be how the hacker got in. The Ethereum community discussed how to proceed and eventually decided to “hard fork”(an extreme change to a network’s protocol that causes previously invalid blocks and transactions to become valid) the Ethereum network and move the funds from the DAO to a recovery address where they could be returned to their original owners.

The hack caused a lot of controversy for The DAO and ultimately led to its downfall. In September 2016, Poloniex (crypto exchange) removed The DAO from its platform with Kraken following suit in December 2016 and many others from that point onwards.

In a further blow, in July 2017 the United States Securities and Exchange Commission ruled that tokens offered and sold by a virtual organization like The DAO were securities that are subject to the federal securities law.

Translation: The DAO and its investors were now violating federal securities laws.

This proved to be the final nail in the coffin for a pioneering project that changed the way we think about business in the digital era.

The DAO’s Legacy

Since its downfall, The DAO continues to teach us valuable lessons. Firstly, the importance of operating on secure blockchain platforms (It’s important to note that the hacking of DAO wasn’t caused by a fundamental problem with Ethereum’s blockchain but by a coding defect recognized by an experienced hacker).

Secondly, the SEC’s ruling inspired blockchain startups to devise ways around the security and federal regulations. One way to do this is by employing the SAFT method. A SAFT is a type of investment contract created to help crypto ventures raise money without violating financial regulations.

We have to admit that despite its ultimate failure, The DAO had an impressive journey. It secured the largest crowdfunding of its time and is still considered a revolutionary project that changed the world for the better.

DAO secured the largest crowdfunding of its time and is still considered a revolutionary project that changed the world for the better

Tweet

Examples of How DAOs are used today

So far DAOs are being used for many purposes such as investment, charity, fundraising, borrowing, or buying NFTs, all without intermediaries.

DASH

DASH is a cryptocurrency that was launched in 2014, formally known as Xcoin and later Darkcoin before settling on its current name in 2015. DASH was originally conceived to ensure user privacy and anonymity and is operated by a subgroup of its users called “masternodes”.

These users are said to streamline the validation and verification of transactions while reducing the number of required nodes per transaction to a more reasonable number. This significantly reduces the costs inherent in maintaining a large number of nodes over long periods of time.

DASH is an open-source enterprise with a decentralized payment network. This means that users customers and vendors can exchange currencies without needing to rely on a third party to keep the network up and running.

As of August 2021 DASH was the world’s 50th most valuable cryptocurrency by market capitalization (2.6 billion).

Tweet

DASH intends to become a go-to for daily transactions that can be used via PayPal, credit card or cash. It’s also invested heavily in research in recent years and has funded a blockchain research lab in collaboration with Arizona state university.

Through its investments DASH aims to improve research, education, and development to upgrade blockchain transaction speed, efficiency and security.

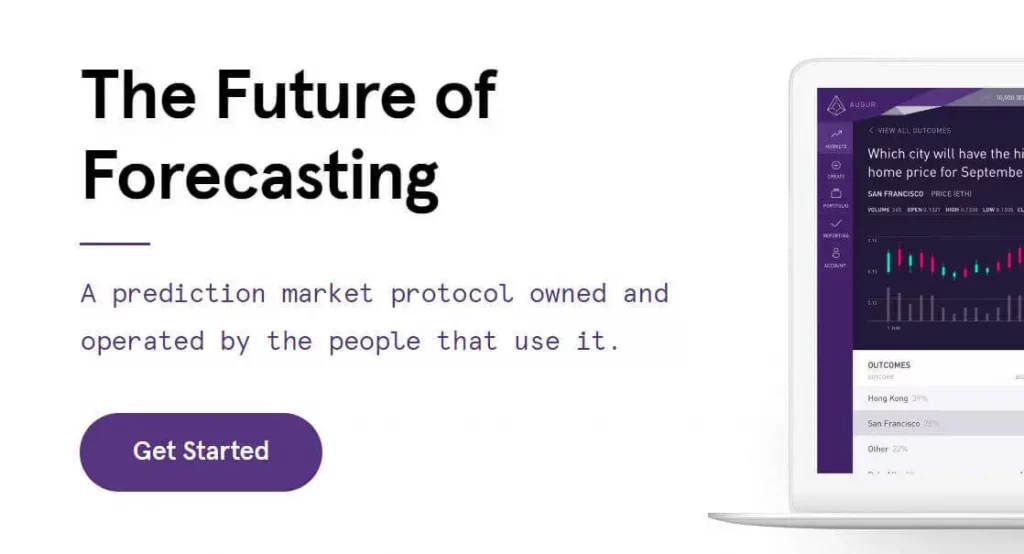

Augur

Augur is a decentralized prediction market platform built on the Ethereum blockchain. It was developed to allow crypto users to benefit from the “wisdom of the crowd” concept whereby future events like elections can be predicted by averaging users’ responses.

Augur achieves this by monetizing correct answers. Basically, the users who speculate correctly win money, while the rest don’t. Somewhat like betting, the more unlikely the predicted event is, the bigger the reward.

Augur uses an advanced prediction model to generate real-time data. Its forecasts to date have proven more accurate than many leading experts.

This is all made possible because Augur functions as a DAO, so it doesn’t belong to any single individual, government, or company. Crowdsourcing intelligence has many potential applications. DAOs like Augur are leading the way.

Steemit

Steemit is a blockchain-based DAO and social media platform where users can earn cryptocurrency (STEEM) for uploading content and voting on posts and comments. Founded in July 2016, by blockchain developer Daniel Larimer, Steemit provides an open database where users can access content in a plain-text format.

The Steemit network uses three different cryptocurrencies: STEEM, Steem Dollars, and Steem Power.

STEEM – Steemit’s original digital currency. It can be freely traded, sold or converted into other cryptocurrencies as well as being converted into Steem Dollars (SBD) or turned into Steem Power (SP).

Steem Dollars – Traded within the Steemit community for upvotes or shares. Only valid on the Steemit platform. Generally speaking, one steem dollar can be thought of as the amount of Steem needed to reach $1USD, while considering the exchange rate.

Steem power is used to symbolize a user’s influence. More Steem Power means their upvotes and downvotes hold more weight.

Uniswap

Uniswap is a decentralized automated crypto exchange built on the Ethereum blockchain.

The platform was built in 2018 to create an exchange that used a decentralized finance protocol for cryptocurrencies and tokens as opposed to the centralized protocols of other platforms. Uniswap has its own cryptocurrency and governance token called UNI. These tokens were originally distributed to early users of the protocol. Owners of the native cryptocurrency can vote on any changes to the protocol that are then applied by a team of developers.

Uniswap is an important part of the DAO story due to the influence it’s had on other organizations that now operate in similar ways. Some examples include PancakeSwap, SushiSwap, BurgerSwap, Curve and DODO.

The market capitalization of the UNI token is over 6.6 billion USD (February 2022).

PleasrDAO

PleasrDAO is a group of digital artists, NFT collectors and DeFi leaders whose main purpose is collecting high-value NFTs that require large investments and sharing the cost of ownership among its members. The PleasrDAO community shares ownership of these contracts by using smart contracts. As a decentralized platform, any issues are discussed through voting systems and group chats.

Originally launched in March 2021, the most notable purchases to date were the acquisition of an Edward Snowden NFT for $5.5 million and a one-of-a-kind copy of a Wu-tang-clan album that sold for $4 million USD. The collective is also famous for turning the original Doge meme into a token.

ConstitutionDAO

ConstitutionDAO is a DAO that almost succeeded in buying the US constitution.

It was formed in November 2021 and through crowdfunding managed to raise $47 million in Ether.

Despite ultimately losing its bid in the Sotheby’s auction, ConstitutionDAO is an example of the power of DAOs and their potential to influence how individuals can purchase things, and how businesses can operate.

MakerDAO and DAI

MakerDAO is a peer-to-peer (p2p) platform developed on the Ethereum network to facilitate lending and borrowing using cryptocurrencies and smart contracts.

DAI, formerly known as SAI is a stablecoin (a subset of crypto concerned with minimizing volatility) cryptocurrency that uses an automated system of smart contracts to maintain a value as close to the USD as possible. This strategy is employed to reduce volatility and allow multiple DeFi features like lending borrowing and trading.

DAI is sustained and regulated by MakerDAO, it’s centralized governance community which aims to maintain its price stability. DAI can also be bought using fiat currencies on most crypto exchanges.

DAI and MakerDAO are considered the first successful decentralized finance platforms

The future of DAOs

So what’s in the pipeline for the next-gen DAO’s?

It’s more than likely that the emergence of DAOs and other concepts in the crypto space is going to change the way we live and work in the future. The average person may longer need to work for a large corporation specializing in one area for most of their adult lives.

The emergence of DAOs and other concepts in the crypto space is going to change the way we live and work in the future

Tweet

DAOs might allow people to earn a living in increasingly non-traditional ways like voting and commenting on a platform like Augur or playing online games, studying, and creating NFTs.

Our future work will be influenced by the networks that are already flourishing around crypto protocols, which are revealing themselves to be modern ways of measuring, coordinating, and rewarding the interaction between complex ecosystems.

This kind of occupational revolution won’t happen overnight. But the DAO could be at the forefront of this shift by coordinating these new types of work outside the control of corporate systems.

This is no longer just an idea, DAOs are genuine organizations currently managing billions of dollars in capital by providing real products and services to people all over the world. What are your thoughts on the latest DOA developments? Share it below in the comments!